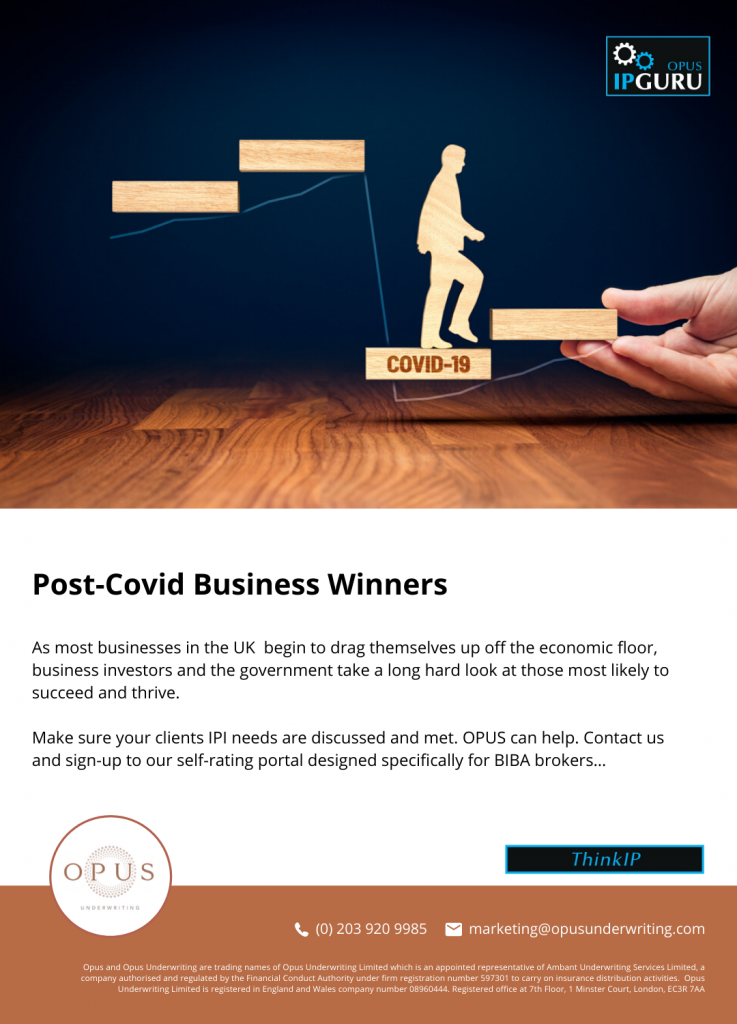

Picking a winner

Racing may be back on the telly, although not as we knew it, and spotting a winner is distinctly an armchair pursuit, at least for now. Picking a start-up business winner continues seemingly unabated for business investors, despite Covid-19 setbacks. Some rules have changedin the quest to distinguish unicorns from nags.

Good Apple

Enter business investment shining knight Pascal Cagni former head of Europe, Middle East and Africa for Apple and once regarded as Steve Jobs right hand, accompanied by another ex-‘ Applester ’ Raphael Crouan. Through their venture capital firm, C4 Ventures, they have raised £88m to go unicorn hunting. So, what are they looking for?

Post-Covid winners

Cagnireportedly posits: “ Although Covid-19 is going to bring about economic slowdown, it is also going to be a breeding ground for innovation and change through disruptive tech. ”

C4’s investment strategy broadly splits the post-Covid business landscape into three categories.With no apology, it is attracted to exploiting first two and avoiding the last.

- The ‘ stay-at-home ’ business Delivering;

- Tools for remote working.

- Remote productivity measurement.

- On-line cybersecurity.

- Home entertainment.

- The ‘ never-again ’ start-up

Providing protection from the consequences of a pandemic recurrence and health support:

- AI and health analysis.

- MedTech solutions.

- Delivering privacy around health data.

- Protecting wellbeing.

- ‘ Short-term losers ’

- Live events.

- Traditional retail.

- Luxury goods.

To name a few.

C4 and Cagni could be wrong. It’s quite possible. But it is very clear Cagni believes some start-ups will thrive after the pandemic is over and he intends to pick his winners and capitalise on their success.

Straw in the wind

Only last week our Business Secretary of State, Alok Sharma, kicked off a programme of engagement with business to inform thinking on the economic recovery from Covid-19.

And guess what…? One of the five key ‘ recovery roundtables ’ is;

- Backing new businesses (how to make the UK the best place to start and scale a business).

Told you so

We at Opus always believed it but it was reassuring to hear Cagni say:

“ One thing we learned from our time at Apple is that, in a time of crisis, you should back…companies with defensible technologies and intellectual property…that’s the best way to spot winners. ”

IPI has never been more relevant.

Murray Fairclough

Development Underwriter

OPUS Underwriting Limited

+44 (0) 203 920 9985

underwriting@opusunderwriting.com

Written and researched by Ben Fairclough